coinbase pro taxes missing

In many circumstances Missing Cost Basis Warnings will not have any significant effect on your gains and losses. For individuals in the following states the threshold for receiving a 1099-K is much lower.

Crypto Explainer What Is Fomo Totalkrypto

It should be there on the right side of the Trades tab the Coinbase Pro Exchange importer.

. If youre experiencing an issue with your Coinbase account please contact us directly. Once you sell its called realized gainloss. Coinbase Pro - Taxes Status.

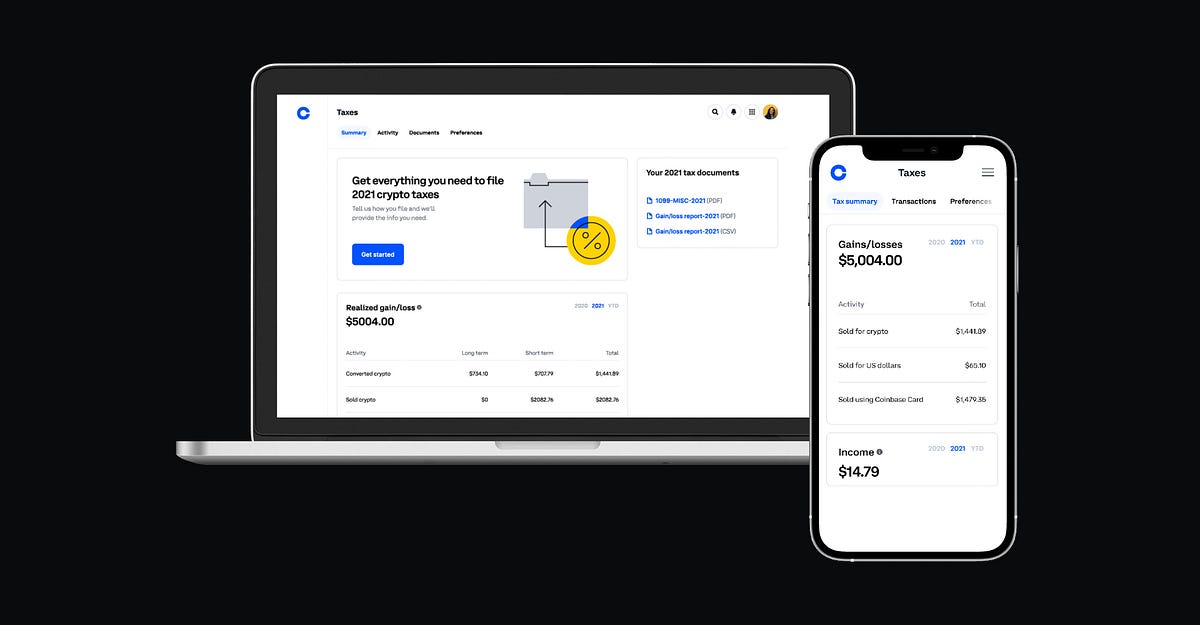

If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead of the 1099-Misc. This information must be provided by December 31 2019. What About Coinbase Pro Tax Documents.

A guide to US. I noticed that the tax section of coinbase pro states information missing. Coinbase Tax Resource Center.

CoinLedger will still run your tax report in spite of Missing Cost Basis Warnings. Coinbase Pro features advanced charting features and a huge range of crypto trading pairs - making it an ideal exchange for more experienced crypto traders. You should only trust verified Coinbase.

Heres everything you need to know about Coinbase Pro taxes and reporting including transaction statements profit. Missing Your tax information is currently missing. Import trades automatically and download all tax forms documents for Coinbase Pro easily.

The customer received it from an external wallet. We are working with Coinbase on a workaround which should be ready very soon well before the US tax deadline. I just looked today on Coinbase Pro and there is a new tab under my profile that says Taxes and then under that heading it says.

Income tab would be more for eCommerce or mining income although as per your other question. But when it comes time to file your Coinbase Pro taxes - it can get a little complicated. For your security do not post personal information to a public forum including your Coinbase account email.

Calculate and prepare your Coinbase Pro taxes in under 20 minutes. You can see the full instructions on how to integrate Coinbase Koinly here. Portfolio trade id product side created at size size unit price fee total pricefeetotal unit This is a problem at this point every Coinbase regularpro user can NOT directly use TurboTax to process their transactions.

There are some cases where Coinbase is missing this information eg. While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS. You pay taxes on profit which happens at the moment of a sale not on the money you decide to keep here or there.

Youll receive the 1099-MISC form from Coinbase if you are a US. Our platform treats this missing data with a zero cost basisthe most conservative approach. I think you should send this up the chain and have your team review this issueconcern.

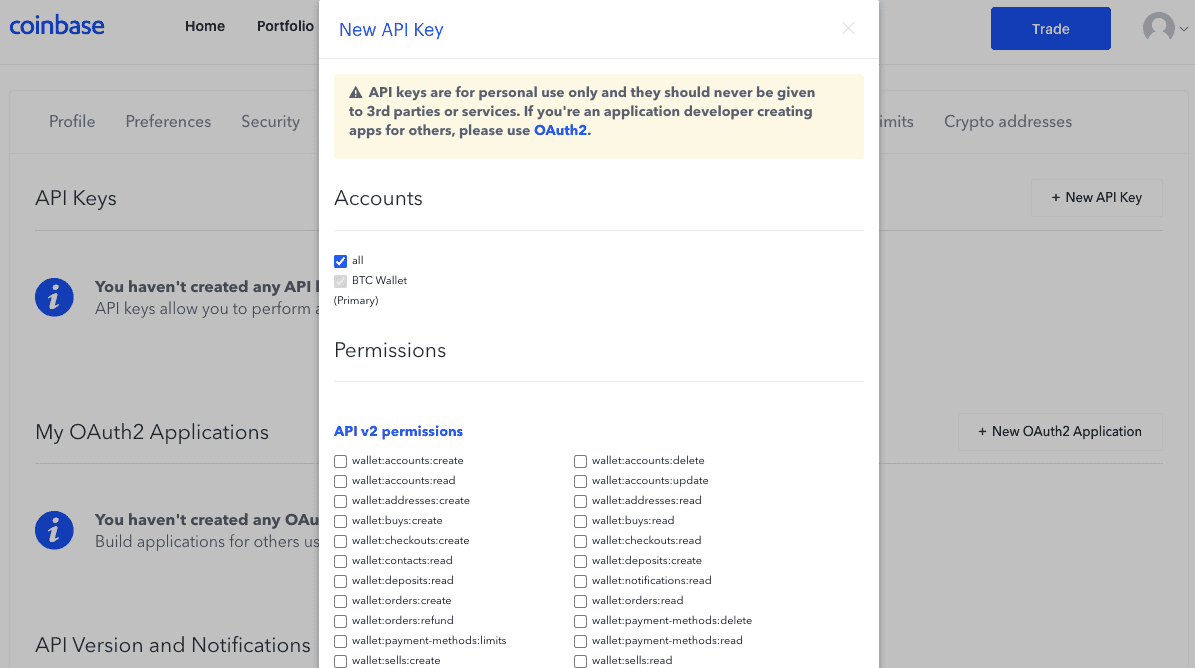

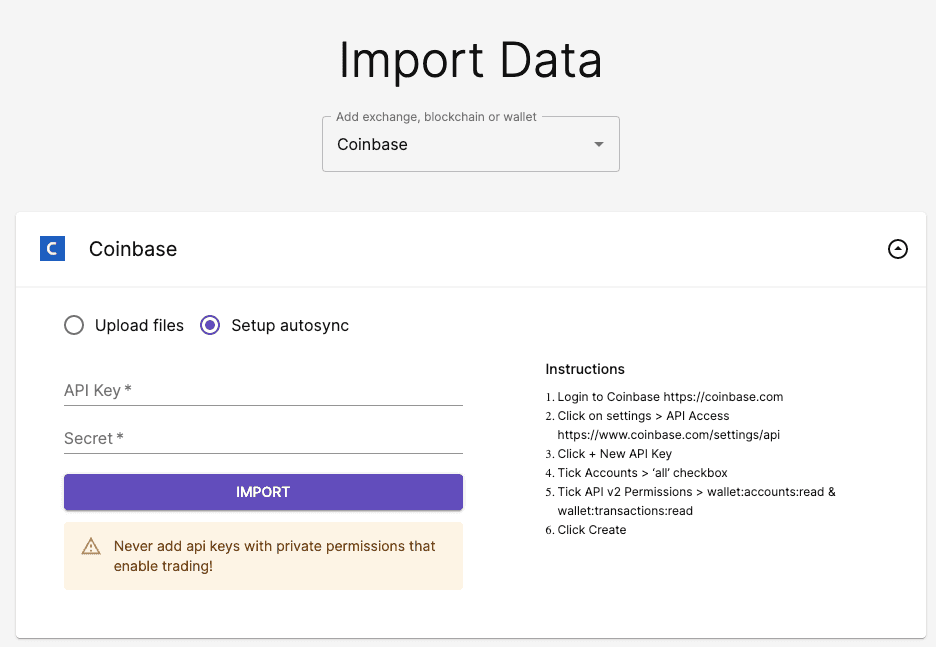

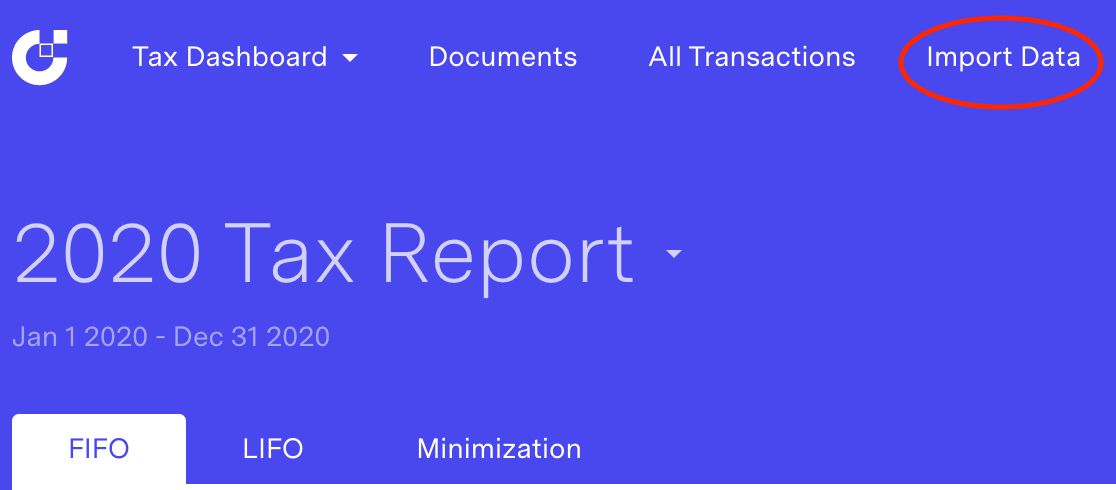

You can automatically import your Coinbase Pro transactions using an API connection or import them manually through a CSV file. Export Coinbase transaction history in a CSV file. Tax forms and crypto reports.

Build with Coinbase Cloud. Coinbase Pro does not return delisted tokens with their API eg. If you use the Coinbase tax reporting API with a crypto tax app - all your Coinbase transaction history will be automatically imported to your chosen app.

Exchange Pro API. Stake tokens to earn rewards. Use the Coinbase tax report API with crypto tax software.

Within CoinLedger click the Add Account button on the top left. We will automatically notify you as soon as this is ready. Read and write blockchain data.

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. New CoinTracker users adding Coinbase Pro to CoinTracker will see these transactions missing. Coinbase and Coinbase Pro customers have free access to tax reports for up to 3000 transactions made on these platforms and get 10 off CoinTracker plans that support the syncing of any other Wallet or exchange.

Tools and APIs for developers building with crypto. Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. Does this mean there is not enough information ie SSN etc to report my.

Resident for tax purposes and earned 600 or more through staking USDC rewards and Coinbase Earn rewards which are all considered miscellaneous income. You traded on both Coinbase and Coinbase Pro but. If you have a case number for your support request please respond to this message with that case number.

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Oracle And Sap Face Cloud Competition From Rimini Street Protocol

The Ultimate Coinbase Pro Taxes Guide Koinly

Everyone Here Is Seriously Missing Out On The Wonderful World Of Defi And Web3 R Cryptocurrency

How To Find Missing Crypto Transactions On Koinly Youtube

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Missed Out On Bitcoin And Ethereum Here S What To Buy Now The Motley Fool

How To Do Crypto Taxes For The Lazy By Lucas Campbell

Everyone Here Is Seriously Missing Out On The Wonderful World Of Defi And Web3 R Cryptocurrency

Issue 14 Defi Insurance Coinbase

Missing Purchase History Again R Koinly

Everyone Here Is Seriously Missing Out On The Wonderful World Of Defi And Web3 R Cryptocurrency

Everyone Here Is Seriously Missing Out On The Wonderful World Of Defi And Web3 R Cryptocurrency

Everyone Here Is Seriously Missing Out On The Wonderful World Of Defi And Web3 R Cryptocurrency